Photo from Pexels

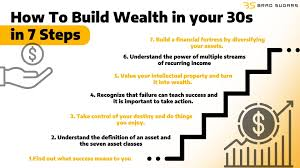

Wealth does not need luck and an unexplainable windfall. It is usually a matter of intelligent practices, proper planning, and hard work. Every person is able to start building their bank account with an appropriate strategy. These are seven practical ways of accomplishing wealth.

1. Establish Financial Objectives

The initial thing is being aware of what you desire. Be it home saving, retirement savings, or a cushion, defining your goals provides focus to your finances. Make large objectives small. This way, you can be focused and monitor your progress. Having a particular plan will bring structure and keep you motivated in the long-term perspective.

2. Adhere to a Budget that Suits You

It can help a lot to make a realistic budget. It does not have to be hard. Begin by recording your expenses and income. Then identify places where you can reduce. It can be as small as cutting down on take-out food or subscriptions. It is not to limit your life but to spend more purposefully. A budget will also make sure that you do not spend any money unnecessarily in order to channel more funds to savings and investments.

3. Create an Emergency Fund

Wisdom in circumstances can be a major setback. It is for this reason that an emergency fund is necessary. It provides financial security. Begin with a small objective, such as setting aside one month of costs. Then slowly accumulate it to three to six months. Put it in a different account where you can access it easily, and it is not connected to the main account that is used to spend the money. This will make it safer.

4. Invest for the Long Term

It is important to save money, but to increase it, you have to invest. Investing your cash in such items as stocks, bonds, or even mutual funds may provide you with some returns in the long term. It is all about consistency. Try creating a recurring payment into a retirement account or an investment fund. It does not matter where you are in the market. Long-term investment is more about waiting than about the choice of the best time. Have your money make money as you go on with other activities.

5. Mix up Your Income Streams

It is dangerous to have a source of income that is dependent. Multiple streams can provide stability and faster growth for you. This may comprise side jobs, rents, or internet services. Some consider such paths as affiliate marketing, being a freelancer, or being a content creator. Others resort to strategies like forex trading that entail purchasing and selling currencies. Regardless of the route you take, you are to generate additional income, which can be saved or invested.

6. Debt Control

Debt may hamper your wealth creation process, and even more so when the debt has high interest. Begin by paying off the debts you have that are the costliest, such as credit cards. Whenever you can, pay over the minimum. You should not incur new debt unless it helps towards your financial plans, like getting a house or financing education.

7. Adapt and Learn

Financial habits are to change over time. Keep in contact with finance and emerging opportunities. Read articles, listen to podcasts, or talk to the financial advisor when there is a need. Your plan has to vary when your income, targets, and life vary. Check on your budget, investments, and savings regularly. The small gains made in time can help influence greater gains in the future. Being updated on your progress makes you smarter and quicker at making decisions regarding finances. Periodical reviews remind you about your goals, point out the areas that need improvement, and enable you to change the course of action when necessary to remain on course financially.

Conclusion

Money does not come in a day. It expands with little steps at a time. Every person can start to improve their financial state with the use of goals and wise finances management, and the creation of healthy habits. Whether you have a clean slate or you are not going to abandon the plan you have already been following, the following seven steps can help you get in control and begin working on securing your financial future.